More than 6 billion eSIM (eUICC- and iUICC-based) capable devices will be shipped cumulatively over the next five years, according to the latest research from Counterpoint’s ETO (Emerging Technology Opportunities) Service. The uptake of eSIMs is poised to grow across a gamut of connected devices over the next decade, led by the flexibility, cost efficiency, security and other myriad benefits offered by the technology.

More than 6 billion eSIM (eUICC- and iUICC-based) capable devices will be shipped cumulatively over the next five years, according to the latest research from Counterpoint’s ETO (Emerging Technology Opportunities) Service. The uptake of eSIMs is poised to grow across a gamut of connected devices over the next decade, led by the flexibility, cost efficiency, security and other myriad benefits offered by the technology.

Commenting on the key eSIM technologies, Senior Analyst Karan Dasaor said, “The eSIM enablement space continues to hum with activity, with an array of companies offering eSIM solutions for diverse applications. These companies fall into three broad categories: 1) eUICC OS embedded in a hardware-based tamper-proof MFF2 or Wafer Level Chip Scale Packaging (WLCSP), miniaturized leadless package form-factors soldered into the PCBs; 2) Software-based eUICC in TEE (Trusted Execution Environment), sometimes called as soft-SIM or virtual SIM; 3) The relatively newer space of integrated UICCs, also called iSIM or iUICC, where the iUICC OS is integrated into a secure enclave within the System-on-Chip (SoC).”

“As it stands, only the hardware-based MFF2 and WLCSP form-factors are compliant with the security standards defined in GSMA’s SGPv.01/02/21/22 specs. Vendors engaged in supplying these chips are required to be GSMA SAS-UP (Security Accreditation Scheme for UICC Production) certified. Non-compliant proprietary software-based eSIM solutions (mostly iSIM and soft-SIM) are available from various ecosystem players, including component vendors, device manufacturers and operators. The iSIM is seeing a rising adoption, particularly in IoT applications, and is being evaluated to make it a part of GSMA specifications in future. On the other hand, the soft-SIM has seen greater adoption in markets such as China, within smartphones for international roaming services monetization by OEMs, and in IoT applications which are not that security-sensitive.”

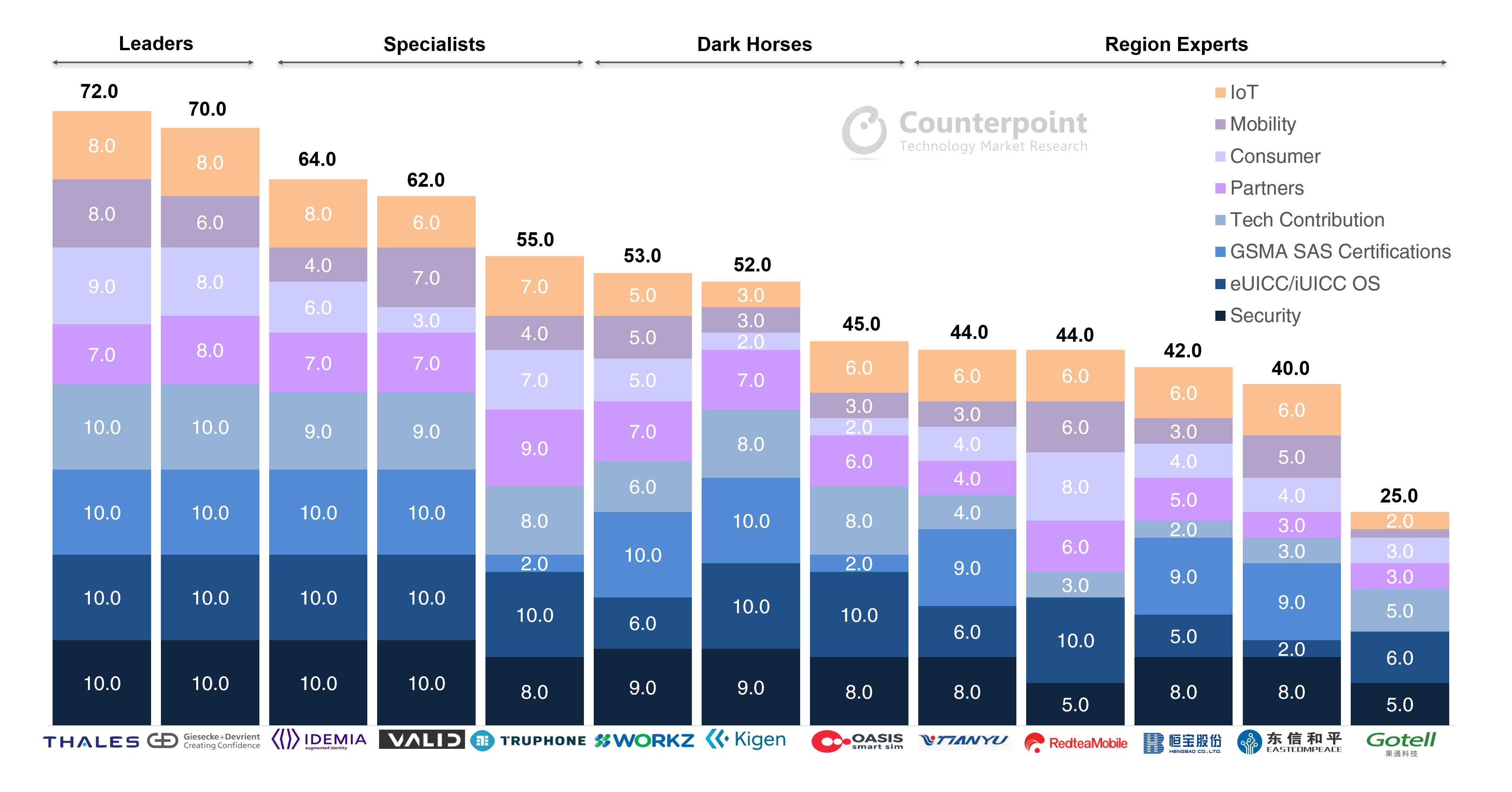

Counterpoint has used its proprietary CORE (COmpetitive Ranking and Evaluation) framework to help the industry better understand and identify key players driving the thriving eSIM ecosystem. The deep-dive analysis and evaluation focuses on the relevant capabilities based on several interviews with different players. It showcases their strengths, ecosystem reach and several other criteria.

Companies such as Thales, G+D (Giesecke & Devrient), IDEMIA and VALID are the leading hardware-based eSIM enablement players integrating their GSMA-compliant eUICC OS into the MFF2/WLCSP chipsets supplied by the likes of ST Micro, Infineon and NXP. Players such as Truphone, Kigen (Arm spinoff), Oasis and RedteaMobile have also partnered with chipset players, module vendors, device OEMs and MNOs to offer eSIM and iSIM solutions expanding the supplier landscape.

Exhibit 1: eSIM Enablement CORE Scorecard and Analysis for Integrated Players

Source: eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020

Source: eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020

Commenting on the competitive landscape, Research Vice-President Neil Shah said, “Conventional SIM card players Thales and G+D continue to lead the eSIM enablement race, driven by end-to-end secure GSMA certified eSIM solutions, technology contribution, diverse partnerships across the value chain and growing customer base. They are followed by IDEMIA and VALID in third and fourth spots respectively, scoring well across the board. Wuhan Tianyu, which is among the handful of Chinese vendors fully compliant with GSMA’s SAS-UP and SAS-SM certifications, has taken notable strides towards eSIM applications leveraging the IoT boom in China.”

Shah added, “The upstart eUICC players such as Kigen, Oasis and Workz are the dark horses looking to challenge the leaders with unique offerings, broadening partner and customer base with greater focus on IoT applications.”

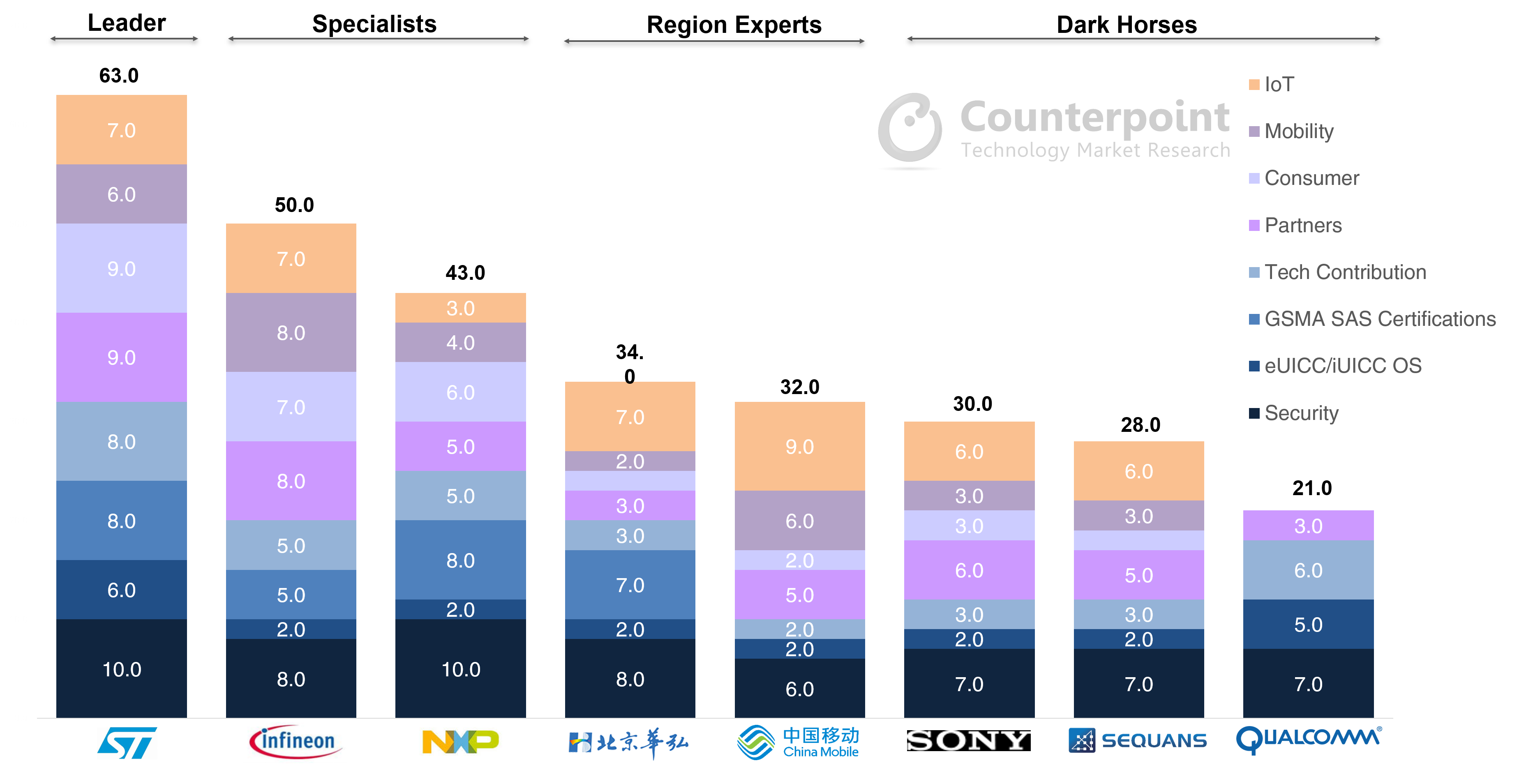

Semiconductor companies such as STMicroelectronics, NXP and Infineon have been the key suppliers of secure hardware eSIM chipsets, partnering with the eUICC OS vendors as above and in some cases having own in-house integrated solutions. ST Micro, for instance, has seen a marked growth in its eSIM solution adoption for consumer and IoT deployments, whereas Infineon has been the key supplier for eSIM in mobility applications.

Commenting on the future evolution of eSIM form-factors, Research Director Dale Gai added, “Players such as Sony Semiconductor (Altair Semi), Sequans and Qualcomm have played a key role in driving iUICC implementations in partnership with different ecosystem players to bring iSIM solutions across IoT applications. As we move towards the iSIM era, players designing SoCs, from Qualcomm to MediaTek to Apple, will dominate and drive the integrated SIM capabilities within their chipsets, helping save board space, and have more control with the ability to scale across consumer, mobility and IoT applications.”

Exhibit 2: eSIM Enablement Scorecard Evaluation and Analysis for eSIM Hardware Enablement

Source: eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020

Source: eSIM Ecosystem – Opportunities, Trends, Evaluation, Analysis and Outlook, December 2020